Hello, fellow financial explorers!

Today, we’re diving into the topic of are unit trusts a good investment.

But hold on tight, because there’s a twist to this tale that might just change your perspective.

1. The Fees

Peeling Back the Layers: Understanding the Costs

Alright, let’s break it down. You’re probably wondering, “What’s the deal with these investment costs?” Well, my curious friend, when you invest in unit trusts, there are certain fees associated with the journey.

When you dive into the world of unit trusts, you’re essentially joining forces with a team of experts who manage your funds. These experts are like the guides on your financial adventure, showing you the best routes to potential profits.

Unmasking the Fees: What’s on the Bill?

Now, you might be thinking, “What exactly am I paying for?” Great question! You’re paying for the services of these financial guides, also known as fund managers.

They’re the ones who do the heavy lifting – researching, analyzing, and making decisions to potentially boost your investment.

But like any skilled professional, they’re not working for free. So yes, there are fees involved.

But here’s the silver lining: these fees are a small price to pay for the potential returns that unit trusts can bring.

It’s like hiring a personal chef to cook you a delicious meal – you pay for their expertise, and you enjoy the delightful feast.

2. Less Control of Investment

The Myth of Total Control: Letting Go with Unit Trusts

Imagine your investment journey as a road trip. When you take the wheel, you’re in control of every turn, every pit stop, and every decision. Now, think of unit trust funds as a cozy tour bus – you’re still on the journey, but someone else is handling the driving.

Yes, it’s true that in unit trust investments, you won’t have the power to handpick every single asset or stock yourself.

The fund managers will be the ones curating the portfolio. But before you start feeling uneasy, let’s look at the bright side.

Trust the Experts: Why Less Control Can Be a Good Thing

Here’s the thing: fund managers are like your financial co-pilots. They’ve got the maps, the GPS, and years of experience navigating the markets. So while you might not be picking the exact stocks, you’re entrusting your investment to professionals who live and breathe this stuff.

Think of it as hiring a personal shopper. You might not personally select each clothing item, but the shopper knows your style and preferences, ensuring you end up with a wardrobe that suits you perfectly. Similarly, fund managers tailor your investment to align with your risk appetite and financial goals.

The Hidden Gem: Customized Management for Your Goals

Now, let’s turn the tables a bit. When you’re busy with work, social life, and Netflix marathons, who’s got the time to constantly monitor the market? Fund managers, that’s who! They’re the ones tracking market trends, analyzing data, and making timely adjustments.

So, while you might not be the one executing every trade, you’re benefiting from their expertise.

It’s like having a personal trainer – you’re not designing the workouts, but you’re getting fitter because of their guidance.

Remember, it’s not about being in the driver’s seat all the time; it’s about reaching your destination safely and comfortably.

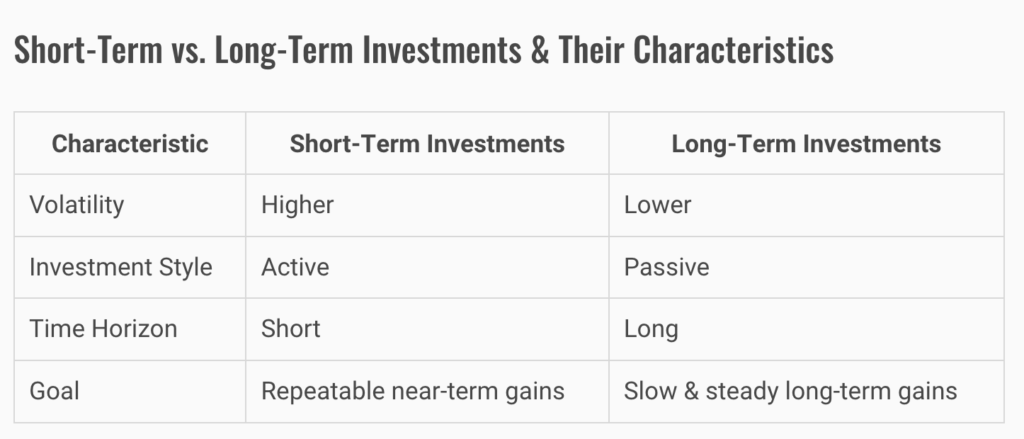

3. Not Suitable For Short-Term Investment

The Patience Predicament: Why Short-Term Might Not Suit Unit Trusts

Picture this: you’re in a race, sprinting towards the finish line. Now, imagine that race as your investment journey. If you’re looking for quick gains and instant results, unit trusts might not be your running shoes of choice.

Unit trusts, with their diversified portfolios and strategic approach, tend to play the long game.

They’re more like marathon trainers – focused on steady progress rather than rapid sprints. So, if you’re after immediate returns, you might find unit trusts a bit patient for your taste.

The Beauty of Time: Why Unit Trusts Thrive Over the Long Haul

But here’s where the plot thickens: unit trusts’ strength lies in their long-term potential. They’re not here to offer quick wins that fizzle out like fireworks. Instead, they aim to build substantial growth over time.

Imagine you’re planting a garden. You sow the seeds, water them, and patiently watch them grow. Unit trusts are similar – they require time to nurture and bloom. While short-term investments might offer fleeting highs, unit trusts are focused on delivering sustainable and substantial returns in the long run.

Source from The Street.

The Grand Reveal: The Unforeseen Advantage of Long-Term Strategy

And now, let’s flip the script. The very aspect that might seem like a drawback – the focus on the long term – is actually a secret weapon for your financial success. Think of unit trusts as your patient mentor, guiding you towards a brighter financial future.

When you commit to a long-term strategy, you’re setting the stage for compounding to work its magic. Compounding is like a snowball rolling down a hill – it starts small, but as it gathers momentum, it grows larger and faster. This means that over time, your returns can multiply significantly.

So, while short-term investments might offer a quick buzz, unit trusts are your ticket to building lasting wealth. By embracing the power of time and patience, you’re positioning yourself for a more secure and prosperous financial journey.

Summary

Now, imagine you’re on a trip.

With unit trusts, you’re like a passenger on a comfy bus, and the experts are driving. They pick where to go, just like fund managers pick where to invest your money. It might sound like you’re not in charge, but these experts really know their stuff.

And guess what?

Unit trusts are like a friend who’s really good at games – they like playing for the long run. Quick wins are fun, but unit trusts are like planting seeds that grow into big trees over time. It’s like having a special superpower for your money.

Remember, the key is to weigh the potential returns against the costs and decide if it aligns with your financial goals. So, whether you’re a newbie in the investment world or a seasoned traveler, don’t let the investment costs scare you away. Instead, consider them as part of the grand adventure towards building a secure financial future.

Stay tuned for more insights as we continue our exploration into the world of unit trusts.

Click here to read more on Fixed Deposits vs Unit Trust Malaysia.