Let’s dive into the world of numbers and discover how the returns of fixed deposits and unit trust Malaysia.

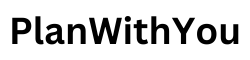

Imagine you have RM10,000 (Malaysian Ringgit) that you’re considering investing.

You want to explore two paths – one with a fixed deposit and the other with a unit trust.

Fixed Deposit Avenue:

You decide to go the traditional route and invest RM10,000 in a fixed deposit with an annual interest rate of 3%. At the end of the year, your investment has grown to RM10,300. Nice and steady, just like a relaxing stroll.

Unit Trust Adventure:

On the other hand, you’re intrigued by the potential of unit trusts. You choose a unit trust fund that has historically provided an average annual return of 8%. You invest your RM10,000 and let it dance in the market for a year.

At the end of the year, your unit trust investment has blossomed to RM10,800. That’s RM500 more than the fixed deposit! The tango of diversity and growth certainly paid off.

The Grand Finale:

Now, here’s where it gets interesting. Let’s fast forward a bit. Say you continue to invest in the same unit trust fund for the next five years. Assuming the average annual return remains consistent at 8%, your RM10,000 investment could potentially grow to around RM14,693.

Meanwhile, if you stick with the fixed deposit at 3% annual interest, your initial RM10,000 would have grown to around RM11,944 after five years. That’s quite the difference!

Comparing Unit Trusts and Fixed Deposits

Are you ready to dive into the world of investments, but feeling a tad overwhelmed by the options? Don’t worry, we’ve got your back! Today, we’re unraveling the mystery of unit trusts and fixed deposits, two popular choices for Malaysian investors like you.

Let’s break it down so you can confidently make the best decision for your hard-earned money.

The Fixed Deposit Waltz: Graceful Steps of Safety and Predictability

Imagine you’re at a grand ball, gliding elegantly across the dance floor with a partner who knows all the right moves. That’s the feeling of a fixed deposit – smooth, secure, and oh-so-predictable. Fixed deposits are like the waltz of investments – they offer a steady rhythm of returns, perfect for those who prefer a graceful, low-risk approach.

Here’s the twist: fixed deposits promise you a set interest rate, and they deliver exactly that. It’s like having a dance partner who never misses a step. While the returns might not be as extravagant as a tango, they offer stability that’s as comforting as a warm embrace. So, if you’re seeking a low-risk, dependable investment dance, fixed deposits might just be your perfect partner.

The Unit Trust Tango: Spirited Moves of Diversity and Growth

Now, let’s switch up the music and hit the dance floor with a dash of spice and excitement. Say hello to the unit trust tango – a vibrant dance of diversity and potential growth. Just like a tango involves intricate moves and seamless transitions, unit trusts bring together an array of assets that move in harmony.

Picture this: unit trusts are like dancing with a group of partners, each bringing their unique flair to the dance floor. These partners are various assets, from stocks to bonds, all guided by the skilled choreography of a fund manager. While the unit trust tango may offer the chance for higher returns, it also comes with a more daring risk profile. Think of it as a thrilling dance that requires a bit more confidence and a dash of adventure.

Finding Your Dance Partner: Balancing Risk and Reward

Now, let’s talk about the intricate steps of evaluating risk and returns when choosing between fixed deposits and unit trusts. Just like a seasoned dancer, you’ll need to balance the thrill of the tango with the elegance of the waltz.

Deposit Interest Rate in Malaysia increased to 1.95 percent in 2022 from 1.56 percent in 2021.

Source from Trading Economics.

Consider this: fixed deposits offer low risk and steady returns, perfect for those who prefer a smooth and predictable dance. On the other hand, unit trusts provide diversity and potential growth, ideal for those who want to add a dash of excitement to their investment routine. It’s all about finding the dance partner that complements your financial style and aspirations.

The Verdict: It’s Your Investment Recipe

So, what’s the verdict?

Choosing between unit trusts and fixed deposits is a bit like deciding between a gourmet feast and a comforting cup of tea – both have their perks!

If you’re all about diversity and are willing to embrace a bit of risk for potentially higher returns, unit trusts might be your jam.

On the other hand, if stability, predictability, and a side of safety sound like your perfect combo, fixed deposits could be your ideal choice.

Remember, there’s no one-size-fits-all answer. It all boils down to your financial goals, risk tolerance, and appetite for adventure.

If you’re interested in knowing more on how to start your unit trust adventure, contact us today!

Happy investing, and bon appétit!