Understanding the Current Malaysia Bank Interest Rate Landscape

Hello there, curious readers! If you’re wondering why your savings aren’t growing as much as you’d like, let’s talk about Malaysia’s bank interest rates. It’s like diving into a pool of financial knowledge, and we’re here to help you navigate the waters.

Deciphering the Current Scenario

Imagine Malaysia’s bank interest rates as the heartbeat of the economy. These rates are set by the central bank and influence how much you earn on your savings.

In recent times, you might have noticed these rates have been dancing around lower levels. It’s like a music tempo that’s shifted down a notch. But why does that matter to you?

Impact on Your Savings

Well, imagine your savings as a growing plant.

When the interest rates are high, it’s like sunshine and rain pouring on your plant, causing it to bloom. But when rates drop, your plant still grows, just at a slower pace.

Similarly, when bank interest rates are low, your savings grow, but not as rapidly. It’s like the plant getting just a sprinkle of water.

So, you might find your hard-earned money isn’t multiplying as much as you expected. If you’ve been stashing your funds in a traditional savings account, you might have noticed that the returns are not as exciting as they used to be. But worry not, there’s a bright side!

Seeking Alternatives for Growth

In a world of low bank interest rates, it’s time to think outside the savings account box. While traditional methods might not yield the returns you dream of, there are alternatives that can help your money flourish. One such alternative is investment linked solutions.

Think of it as a new adventure for your money – a way to potentially earn higher returns while safeguarding your financial future. It’s like setting sail on a ship to a treasure island, where the treasure represents your financial goals.

Investment linked solutions offer a dynamic approach that combines the benefits of insurance and investments. This way, your money has the opportunity to grow while being protected from the financial storms that life might bring.

In a nutshell, understanding Malaysia’s bank interest rate landscape is like knowing the weather forecast for your financial journey. While low interest rates might slow down the growth of your savings, there are alternative paths like investment linked solutions that can lead you to brighter financial horizons.

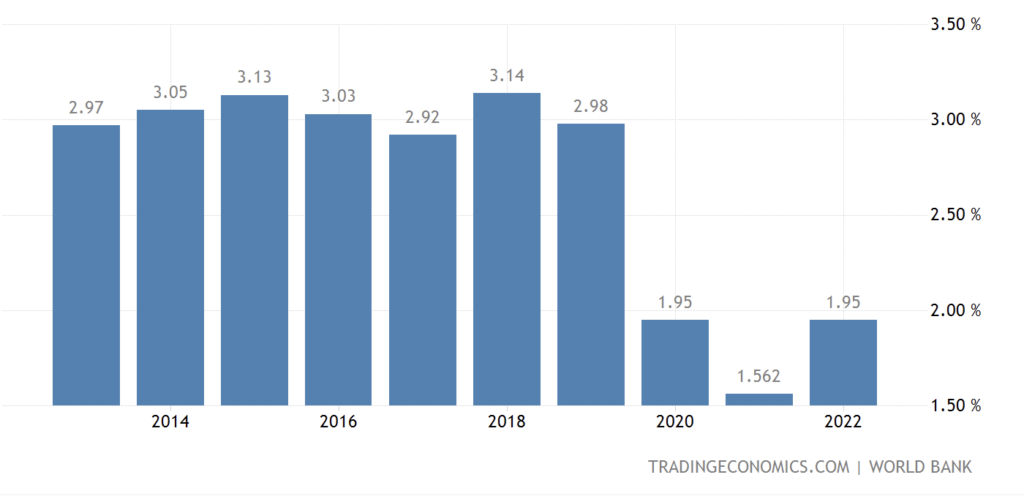

In 2022, the deposit interest rate in Malaysia increased by 0.4 percentage points (+25.64 percent) since 2021. In total, the deposit interest rate amounted to 1.95 percent in 2022. This increase was preceded by a declining deposit interest rate.

So, don’t let those low rates rain on your parade – explore new avenues for growth and sail towards your treasure island of financial prosperity!

Source from Statista.

Investment Linked vs. Fixed Deposits: The Returns Battle

Are you curious to explore the exciting arena of investment linked solutions versus fixed deposits? It’s like a friendly face-off between two contenders, and we’re here to lay out the ringside seats for you.

The Traditional Hero – Fixed Deposits

Imagine fixed deposits as your reliable, old friend. They’re like a cozy blanket for your money, offering stability and a predictable return. When you deposit your money into a fixed deposit account, you’re essentially lending it to the bank for a fixed period, and in return, the bank promises to pay you a predetermined interest rate.

But here’s the twist: in today’s low bank interest rate environment, that cozy blanket might feel a bit thin. While fixed deposits offer security, the returns might not be as exciting as they used to be. It’s like having a dependable but slightly underwhelming sidekick on your financial journey.

The Dynamic Contender – Investment Linked Solutions

Now, enter the dynamic contender: investment linked solutions.

Think of them as the cool, adventurous cousin of fixed deposits. Instead of just tucking your money away, these solutions put your funds to work in the investment world. It’s like giving your money a chance to spread its wings and explore new horizons.

Investment linked solutions combine the benefits of insurance and investments. A portion of your funds is allocated to insurance coverage, ensuring protection for you and your loved ones. The remaining portion is invested in various assets like stocks and bonds, with the potential for higher returns.

Imagine your money as a versatile athlete participating in a financial triathlon – insurance, growth, and protection all in one package. The returns can vary based on market performance, but they have the potential to outshine the limited growth of fixed deposits, especially in a low bank interest rate era.

Evaluating the Match: Stability vs. Potential

So, how do you decide between the two contenders in this returns battle? It boils down to your financial goals, risk appetite, and preferences. Fixed deposits offer stability and are ideal for those seeking minimal risk and guaranteed returns. They’re like a classic black dress – always reliable, but perhaps not the most exciting choice for every occasion.

On the other hand, investment linked solutions provide an opportunity to potentially earn higher returns. They’re like a thrilling roller coaster ride – there might be ups and downs, but the exhilaration and rewards can be worth it. If you’re ready to take on a bit more risk in exchange for the potential for growth, investment linked solutions might be your match.

Ultimately, the returns battle between investment linked solutions and fixed deposits is a decision that’s tailored to your financial journey. It’s like choosing between comfort and adventure.

Are you ready to cozy up with stable returns, or are you excited to set sail on a dynamic investment voyage?

The choice is yours, and the arena awaits your decision!

Strategies for Making the Transition: Safeguarding and Growing Your Funds

Greetings, curious minds! If you’ve been eyeing the shift from traditional fixed deposits to the exciting world of investment linked solutions, you’re in for a treat. Let’s delve into some smart strategies that will help you transition with confidence, safeguarding and growing your funds along the way.

Balance and Diversify for Stability

Imagine your investment strategy as a well-balanced meal. Just as you need a variety of nutrients to thrive, your financial portfolio requires diversification. In the face of the fluctuating Malaysia bank interest rates, diversifying your investments helps you stay steady, like a skilled tightrope walker.

Allocate your funds across different investment instruments – stocks, bonds, real estate – spreading the risks and maximizing potential returns. It’s like having a buffet of financial options, ensuring that if one dish isn’t as tasty, others can still satisfy your hunger for growth.

Embrace the Power of Education

If the world of investments seems as mysterious as a hidden treasure map, fear not! Educate yourself about various investment options and their potential returns. Knowledge is your treasure chest, and the more you gather, the better equipped you’ll be to make informed decisions.

Attend workshops, read financial articles, and seek advice from experts. It’s like being equipped with a trusty compass that guides you through the investment landscape. When you understand where you’re going, the journey becomes less daunting and more exciting.

Set Clear Goals and Stay Consistent

Picture your investment journey as a marathon, not a sprint. Before you embark, define your financial goals. Are you saving for a dream vacation, a home, or retirement? Clarity about your destination gives your journey purpose and direction.

Just as a marathoner follows a training routine, stay consistent with your investment contributions. It’s like taking regular steps towards your goals, building momentum over time. By remaining committed, you weather the ups and downs, knowing that every stride brings you closer to the finish line of financial success.

Consult Experts and Monitor Progress

Think of experts as your seasoned travel guides in the realm of investments. If you’re unsure about which path to take, seek advice from financial advisors who understand the nuances of the market and can tailor strategies to your needs.

Regularly review your investment progress. It’s like checking the map to ensure you’re on the right route. If adjustments are needed, like shifting your funds based on market trends or changes in your goals, do so with the guidance of experts.

In a world where Malaysia’s bank interest rates might seem stagnant, your financial journey doesn’t have to be. By balancing, diversifying, educating, setting goals, staying consistent, and seeking expert guidance, you can navigate the transition to investment linked solutions with ease.

Think of these strategies as your guiding stars, lighting up the path to a future where your funds are both safeguarded and flourishing. So, ready to set sail on this exciting voyage? Your financial adventure awaits!

Contact us today to get started on your financial journey planning.

Real-Life Success Stories: How Investors Gained More with Investment Linked Plans

If you’re wondering whether the shift from fixed deposits to investment linked plans is worth it, we’ve got a treasure trove of real-life success stories to share.

These tales are like inspiring gems that showcase how investors gained more in a world of fluctuating Malaysia bank interest rates.

Sarah’s Serendipitous Investment Journey

Meet Sarah, a young professional with dreams of homeownership. Tired of her savings sitting idle in a fixed deposit account, she decided to explore investment linked plans. It’s like stepping onto a new path, unsure of what’s ahead.

Sarah’s investment journey started with careful research and consultation. She diversified her funds and embraced the dynamic nature of investment linked plans. Over time, her investments grew, contributing significantly to her goal of buying her dream home. It’s like watching a small plant grow into a flourishing tree, bearing the fruits of her financial aspirations.

James’ Voyage to Financial Freedom

James, a family man, was seeking ways to secure his family’s future beyond the limitations of traditional savings accounts. Investment linked plans caught his attention. It’s like discovering a treasure map that promised potential riches.

With the guidance of financial experts, James navigated the investment landscape. He allocated his funds wisely, balancing risks and rewards. As the years went by, the returns from his investment linked plan provided the financial cushion he needed. It’s like watching a ship sail through stormy seas and emerge stronger on the other side.

Aida’s Retirement Dream Come True

Aida, a retiree, was determined to make her golden years truly golden. Instead of letting her savings idle in low-interest accounts, she opted for an investment linked plan. It’s like starting a new chapter filled with exciting possibilities.

By consistently contributing to her investment linked plan, Aida enjoyed the potential for higher returns. As the value of her investments increased, she was able to travel, explore hobbies, and live life to the fullest during her retirement. It’s like watching a caterpillar transform into a beautiful butterfly, spreading its wings in newfound freedom.

These real-life success stories are like beacons of hope, showcasing that even in a world of low Malaysia bank interest rates, investment linked plans have the power to transform financial futures. Sarah, James, and Aida ventured into the world of investments with a mix of determination, education, and expert guidance. Their experiences prove that by embracing change and exploring alternative avenues, you too can set sail on a journey towards financial growth and prosperity.

So, are you ready to create your own success story?

Dive into the world of investment linked plans and discover the potential for greater gains, just like these inspiring individuals did.

Your financial adventure awaits! Let’s start planning today.