Building a Solid Financial Foundation

Hey there, savvy young adults!

If you’re reading this, you’re already a step ahead in your journey towards financial management.

But let’s talk about something crucial – building a solid financial foundation.

Understanding Your Net Worth

Do you know your net worth? Surprisingly, many young adults don’t.

Net worth is simply the difference between what you own (your assets) and what you owe (your liabilities). It’s a snapshot of your financial health.

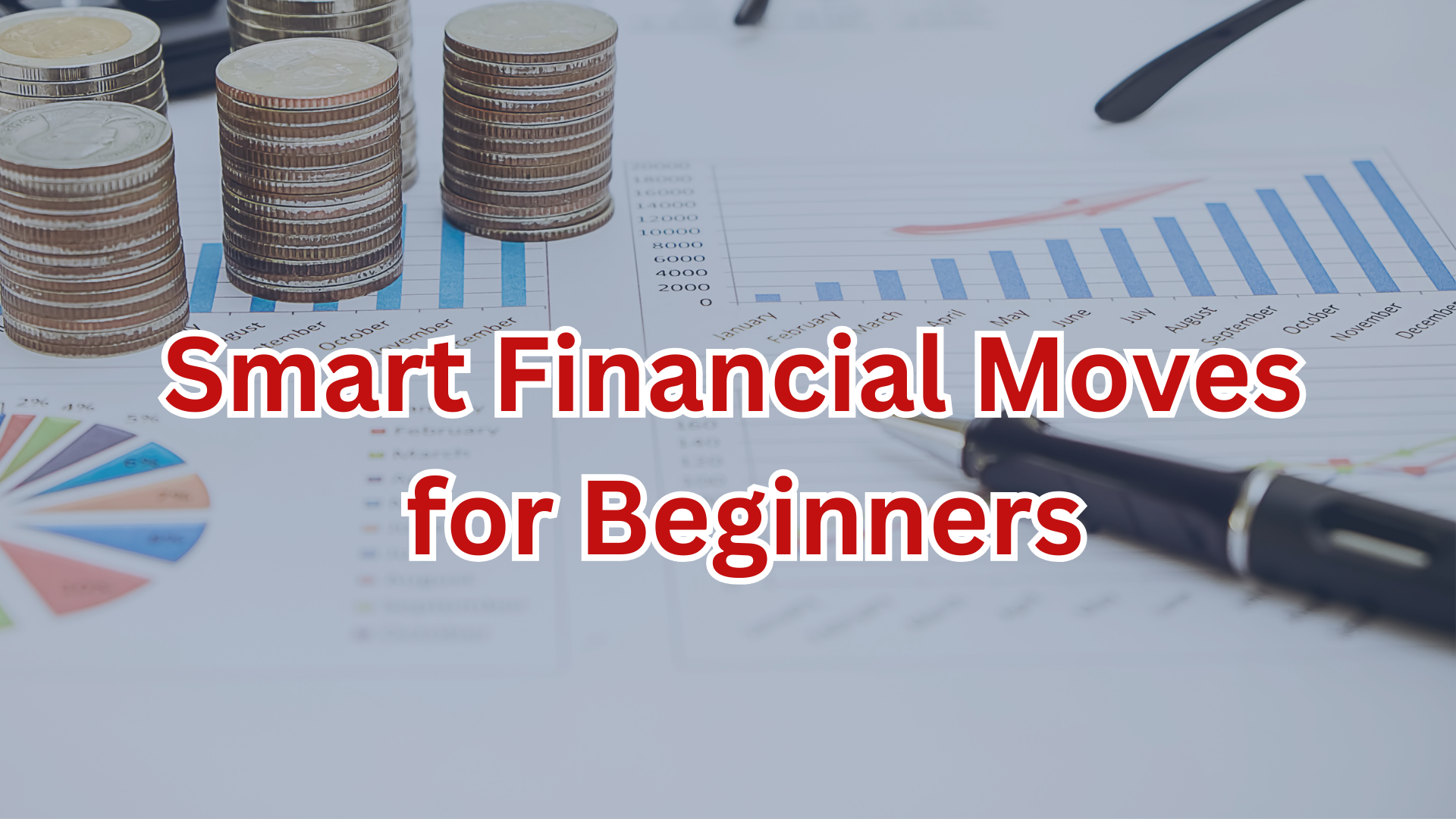

Now here’s the eye-opener: for many, their net worth is lower than the price tag of a Myvi, a popular car in Malaysia that costs around RM60,000.

Yep, you heard that right! Your car is worth more than your total net worth.

The Myvi Dilemma

Consider this: your Myvi takes you places, but your life’s net worth is valued lower than your trusted vehicle. It’s like having a snazzy set of wheels but not enough savings to plan a weekend getaway.

The Awareness Gap

So why is this the case?

One reason is the lack of awareness about personal net worth among young adults.

We often focus on our monthly income and expenses, forgetting the bigger financial picture.

We’re so busy keeping up with our Myvi’s maintenance that we forget to maintain our financial well-being.

You’re Worth More Than Your Wheels

Here’s the thing – you are worth more than the sum of your material possessions. Your net worth represents your financial strength and potential.

It’s about ensuring you’re on track to meet your life goals and financial aspirations.

Assessing Your Net Worth

Assessing your net worth is pretty straightforward.

Start by listing all your assets – that includes your savings, investments, and the current value of your Myvi (or any other assets you own).

Then, tally up your liabilities – this is what you owe, like student loans, credit card debt, and any outstanding bills.

Calculating Your Net Worth

Now comes the math part. Subtract your total liabilities from your total assets.

If the number is positive, congrats! You have a positive net worth.

If it’s negative, don’t fret; it’s a starting point for improvement.

Growing Your Net Worth

So, what’s the goal? It’s to consistently grow your net worth over time. Here’s how you can do it:

1. Prioritize Savings:

Allocate a portion of your income to savings regularly. It’s like putting money in a piggy bank for your future self.

2. Invest Wisely:

Consider investment options like WEALTHLINK 360. It’s an investment-linked plan that can potentially grow your wealth over time.

3. Reduce Debt:

Work on paying down high-interest debts, like credit card balances. Reducing liabilities increases your net worth.

4. Track Expenses:

Keep an eye on your spending. Create a budget to ensure you’re not spending more than you earn.

5. Set Financial Goals:

Define clear financial goals. Whether it’s buying a house, starting a business, or taking an epic vacation, having goals motivates you to increase your net worth.

Your net worth is a reflection of your financial health. Don’t let your Myvi be worth more than you. Start building a solid financial foundation today.

Assess your net worth, set financial goals, prioritize savings and consider smart investment options like WEALTHLINK 360. Your financial future is brighter than the road ahead, so steer wisely!

Investing in Your Future with WEALTHLINK 360

Ready to take a leap into the world of WEALTHLINK 360? Buckle up because we’re about to embark on a journey that’s all about securing your financial future while having a little fun along the way.

Your Financial Superpower: WEALTHLINK 360

Imagine having a financial superpower that allows you to navigate the twists and turns of life with confidence. That’s exactly what WEALTHLINK 360 offers.

It seamlessly combines insurance and investment solutions to create a robust financial plan that’s all about you.

Flexibility Tailored to You

When it comes to investments, one size definitely does not fit all.

With WEALTHLINK 360, you have the power to choose from various investment funds.

It’s like having a buffet of options, and you get to pick your favorites.

Emergency Funds at Your Fingertips

Life is full of surprises, and emergencies can pop up when you least expect them. The good news?

WEALTHLINK 360 allows you to access your funds when needed. It’s like having a financial safety net that’s always there for you.

Calling the Shots: Adjust and Switch

Your financial journey isn’t set in stone.

It’s more like an exciting adventure with detours and shortcuts. WEALTHLINK 360 understands that, which is why it lets you adjust your investment allocations and even switch funds.

It’s like having a GPS for your money!

Expertise at Your Service

Managing investments can be a bit like sailing into uncharted waters.

That’s where the experts behind WEALTHLINK 360 come in.

They’re like the seasoned captains of your financial ship, navigating the markets and making sure your portfolio stays on course.

Protection and Growth Hand in Hand

WEALTHLINK 360 isn’t just about growing your wealth; it’s also about protecting what you have.

Life can throw curveballs, but this financial superhero has your back.

It’s like having a shield against the unexpected.

Your Financial Security Investment

Think of WEALTHLINK 360 as your secret financial security investment. It’s there to catch you when life throws you a curveball and to help you build a solid financial foundation for your future.

The Seamless Blend: Insurance and Investment

What makes WEALTHLINK 360 truly unique is its seamless blend of insurance and investment solutions. It’s like having a Swiss Army knife for your finances, with tools to protect and tools to grow.

It’s All About You

At the heart of WEALTHLINK 360 is you. Your financial goals, your dreams, your peace of mind – it’s all front and center. It’s like having a financial plan that’s tailor-made just for you.

Sum it up

It’s not just about investing; it’s about securing your future while enjoying the flexibility to adjust and the expertise of seasoned professionals. It’s time to take control of your financial destiny – the WEALTHLINK 360 way!

Continuously Improving Your Financial Management Skills

Hey there, financial trailblazer!

Welcome back to our series on mastering the art of financial management.

If you’ve been following along, you’re already on your way to becoming a financial guru.

But the learning journey doesn’t stop here; it’s time to dive into the world of continuously improving your financial management skills.

Unlocking Your Financial Potential

Imagine your financial skills as a treasure chest waiting to be unlocked.

The more you learn and practice, the more treasures you’ll discover.

Whether you’re just starting or you’ve been at it for a while, there’s always room for improvement.

Embrace Lifelong Learning

In the realm of financial management, change is the only constant.

New investment opportunities, tax laws, and financial instruments emerge regularly.

To stay ahead, embrace lifelong learning. Attend workshops, webinars, and read books.

Remember, knowledge is your most powerful financial tool.

Set Clear Financial Goals

Goals give your financial journey direction.

Whether it’s saving for a dream vacation, buying a home, or retiring comfortably, setting clear financial goals is essential.

Break them down into smaller, achievable steps. With each goal you reach, your confidence in managing finances grows.

Budget Like a Pro

Budgeting doesn’t have to be a dreaded task.

Think of it as your financial roadmap. Use apps, spreadsheets, or old-fashioned pen and paper to track your income and expenses.

With a well-planned budget, you’ll have a clear picture of where your money goes, making it easier to save and invest wisely.

Diversify Your Investments

The saying “don’t put all your eggs in one basket” holds true in financial management.

Diversify your investments by spreading them across different asset classes, like stocks, bonds, and real estate.

Diversification helps manage risk and potentially boosts returns.

Review and Adjust Regularly

Financial management isn’t a set-it-and-forget-it endeavor.

Regularly review your financial goals and investments.

Are you on track to meet your objectives? If not, don’t be afraid to adjust your strategies. Flexibility is key to long-term financial success.

Seek Professional Guidance

Just as adventurers rely on maps, financial explorers benefit from expert guidance.

Financial advisors are like seasoned guides who help navigate the complex terrain of investments, taxes, and retirement planning.

Consider consulting one to fine-tune your strategy.

Automate Your Finances

In the age of technology, automation is your best friend.

Set up automatic transfers to your savings and investment accounts.

Pay bills online to avoid late fees. Automation ensures you stay on top of your financial commitments effortlessly.

Stay Informed About Taxation

Taxes are a significant part of financial management.

Understand your country’s tax laws and incentives.

Explore tax-efficient investment options.

Being tax-savvy can help you keep more of your hard-earned money.

Celebrate Your Wins

Managing finances isn’t all about numbers; it’s also about your mindset.

Celebrate your financial victories, no matter how small. It could be paying off a credit card, reaching a savings milestone, or achieving an investment goal.

Positive reinforcement fuels your financial journey.

Teach Others

Sharing knowledge is a powerful way to reinforce your own learning.

Teach friends or family members about financial management.

By explaining concepts to others, you’ll gain a deeper understanding and solidify your skills.

Congratulations, financial adventurer!

You’ve uncovered valuable insights on continuously improving your financial management skills.

Remember, this journey is a marathon, not a sprint. Embrace learning, set clear goals, and adapt to changes.

With determination and the right strategies, you’re well on your way to mastering financial management. Keep the financial fire burning, and your future self will thank you!